|

||

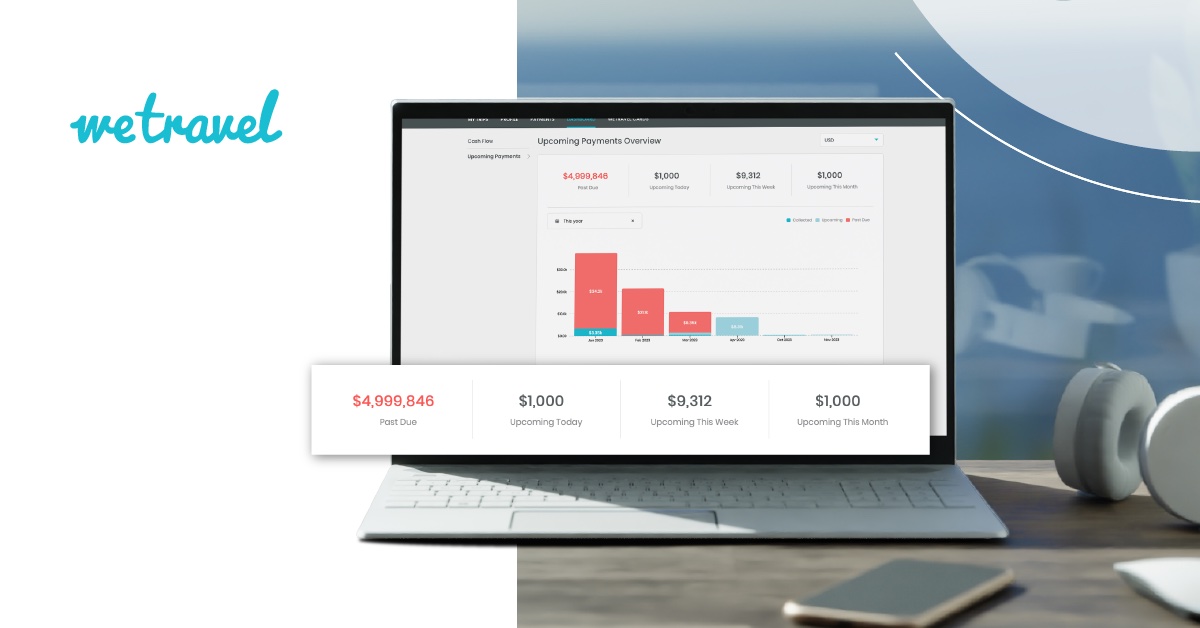

WeTravel Launches Future Cash Flow Dashboard Feature |

||

WeTravel expands its platform’s analytics capabilities to include a cash flow management dashboard, providing travel businesses with a comprehensive forecast and analysis of future earnings |

||

|

||

| SAN FRANCISCO, CA—April 13, 2023—WeTravel—the leading all-in-one business management platform for multi-day travel businesses—launched today a Future Cash Flow Dashboard feature to enable travel businesses that use its platform to in real-time track up-coming installment and past-due payments to analyze their cash flow, as more travelers rely on installment payments in 2023. | ||

| Available to WeTravel Pro clients–an annual, paid subscription that unlocks additional features–the Future Cash Flow Dashboard provides a comprehensive report of expected month-over-month and annual earnings. Access to the dashboard’s forecasting analytics enables travel businesses to view month-to-date expected payments, expected payments and past-due payments to provide an accurate analysis of projected revenue, enabling better financial control and revenue management. | ||

| ”Last year, more than 90 percent of our clients used our Payment Plans features–including deposit and installment payments–to enable their travelers to pay portions of their trips, when it financially worked for their individual circumstances. Offering installment payments helps travel businesses to sell more, but it’s difficult for these businesses to manage and track up-coming revenue,” said Ted Clements, WeTravel’s CEO. “Adding within our existing payment tracking dashboards a feature that enables our clients to track and analyze their future earnings will make it easier to manage their businesses’ cash flow – and better analyze their profits and losses.” | ||

| In 2023, more consumers are opting for installments and buy-now-pay-later (BNPL) payment options when purchasing travel. In a recent study, Amadeus found 68 percent of 5,000 polled travelers confirmed that a BNPL option would encourage them to spend more on their holiday. In December 2022, WeTravel surveyed nearly 200 tour operators and travel organizers in the wellness, student group, travel advisor and destination management companies categories, the survey found that more than 85 percent of these businesses receive travelers payments by installment, with four or more–up to eight for more than 15 percent of respondents–installment payments being most common. In 2019, only 70 percent of the surveyed businesses offered installment payments to their travelers. | ||

| While it’s important for travel businesses to offer their travelers the flexibility to pay for trips as it works for their financial situation, it adds complexity to forecasting a business’s revenue. Travelers have grown to expect flexible payment options and with that comes the need for travel businesses to have the tools to predict and track their future cash flow. The feature allows clients to manipulate data in order to visualize past due trip payments and set up automated emails to follow up with travelers who have overdue installments. | ||

| “At WeTravel, we create new features with the purpose of empowering our clients to grow. We’re excited to offer our newest feature to help travel businesses save time on tracking and managing up-coming payments, instead moving their attention where it counts – on managing a successful and profitable travel business,” said Clements. | ||

| CONTACT Kasi McGurk (she/her), WeTravel’s head of global PR and communications kasi.mcgurk@wetravel.com (647) 523-6916 |

||

| ABOUT WETRAVEL Founded in 2016, WeTravel was built as a platform to support travel businesses by digitizing and simplifying the travel booking process. Now used by more than 3,000 travel companies—to transact with nearly 500,000 travelers and thousands of suppliers, annually—the business has revolutionized how the travel industry manages their businesses with a suite of integrated SaaS and FinTech solutions that fit into an intuitive platform. For further information visit WeTravel’s Press Page or follow WeTravel on LinkedIn and Twitter. |